When even proponents of Modern Monetary Theory (MMT) say the US government is spending like drunken sailors, it might be time for public officials to examine the federal budget. Washington is currently spending as if the economy were on the brink of a financial crisis. With the country embroiled in permanent trillion-dollar budget deficits, a soaring national debt, and rocketing interest payments, could the United States afford to pay for a response to a downturn?

Stopping a Financial Crisis

During the 20th century, Republicans and Democrats initiated stimulus and relief programs following wars, recessions, and depressions.

In response to the 2008 Global Financial Crisis, then-President George W. Bush, with bipartisan support, mailed $300 to $1,200 rebate checks to US households. The president described the $152 billion measure as “a booster shot for our economy” to help curb recession effects. A year later, then-President Barack Obama signed the $831 billion Recovery Act, which consisted of direct cash payments, public works projects, tax credits, and other Keynesian stimulus efforts to stop the bleeding from the financial crisis that happened under his predecessor.

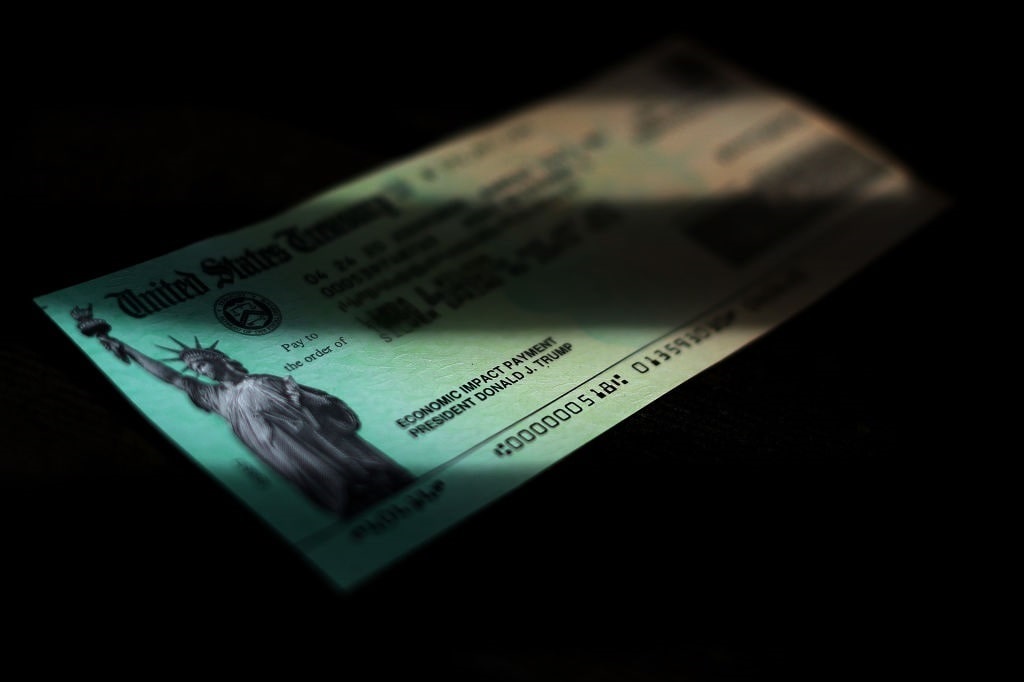

Presidents Donald Trump and Joe Biden employed similar efforts during the coronavirus pandemic. The Republican approved $2.2 trillion through the CARES Act, while the Democrat gave the nod to the $1.9 trillion American Rescue Plan.

Presidents Donald Trump and Joe Biden employed similar efforts during the coronavirus pandemic. The Republican approved $2.2 trillion through the CARES Act, while the Democrat gave the nod to the $1.9 trillion American Rescue Plan.

The idea is that once the economic landscape has successfully navigated through turbulent waters, then the federal government can curtail its spending and return to pre-crisis budget levels. This is no longer the case, as the United States is expected to record trillion-dollar-plus deficits permanently. The latest Congressional Budget Office’s Budget and Economic Outlook suggests that the nation’s capital will have a more than $10 trillion annual budget by 2034, with interest payments eating up to a fifth of revenues. The national debt is forecast to exceed $50 trillion in the next decade.

Since the sunken S.S. Fiscal Responsibility Ship will not be resurrected again, officials need to ask if they can stimulate or rescue the economy should the country slip into a significant slump.

In addition to the nooks and crannies of the yearly budget, the Treasury Department is issuing astronomical amounts of short-term debt securities to manage the shortfalls and growing interest costs. As Liberty Nation News reported, the Treasury has flooded capital markets with $1 trillion of bonds. The challenge is that supply exceeds demand based on auction results and the Federal Reserve trimming its $7.7 trillion balance sheet. Officials also plan to borrow another $847 billion in the final three months of fiscal year 2024.

Republican lawmakers, such as Sen. Bill Hagerty (R-TN), contend that the Treasury is issuing excessive amounts of short-term debt securities to reduce longer term interest rates. They believe this type of manipulation of debt markets constrains the government’s ability to respond to economic shocks down the line. Of course, the central bank produces recessions and depressions, but that is another story.

Are the Treasury’s actions manipulative? It might be comparable to how the White House has engaged in energy policy over the last three years.

Draining Energy Reserves

In response to soaring crude oil prices, the current administration tapped into the Strategic Petroleum Reserve, a rainy-day fund filled with hundreds of millions of barrels of Texas Tea used in emergencies. To help curb price pressures, the president drained about 40% of emergency stockpiles and, according to a White House paper, reduced the average price for a gallon of gasoline by 80 cents.

This is not all. The administration sold off about one million barrels of gasoline from the Northeast Gasoline Supply Reserve heading into the Fourth of July weekend. This program was started in 2012 following Superstorm Sandy, which decimated the region’s refineries and shuttered 40 terminals in New York Harbor. But rather than utilize the stocks for emergencies, all the president’s men and women have decided to raid them for political purposes.

Ultimately, these efforts have injected more supply into the domestic petroleum markets to help limit prices. Administration officials say these mechanisms were instituted to provide breathing room for US households. Critics purport that these have been tactics to bolster electoral chances. Still, prices were impacted by government intervention instead of market fundamentals.

Can the US Afford Anything Anymore?

At this point, it might be legitimate to ask if the United States can afford the basics let alone a financial crisis. The federal government should theoretically be able to keep the lights on without debt ceiling fiascos and commissions since Uncle Sam is raking in near-record revenues of approximately $4.4 trillion. However, the never-ending spending spree on Capitol Hill requires more receipts since around a third of the income tax revenue is dedicated to interest charges.

Remember, many outlooks are based on rosy scenarios absent recessions or wars. However, in worst-case scenarios, the Congressional Budget Office’s projected $10 trillion budget in the next ten years could quickly become $12, $15, or $18 trillion, adding trillions more to the national debt and servicing payments and requiring more money from tapped-out taxpayers. Thanks to bailouts from the Eccles Building, Washington has successfully kicked the can down the road before. Could Republicans and Democrats do it again?