Is Federal Reserve monetary policy restrictive? Chair Jerome Powell and many of his colleagues have insisted that conditions are tight, meaning that policymakers are decelerating money supply growth to slow down the economy. A tidal wave of data suggests that if the desired objective is to eradicate inflation by slowing the economic landscape, then either more interest-rate hikes or higher-for-longer rates might be necessary to erect a mission-accomplished banner on the USS Marriner Eccles.

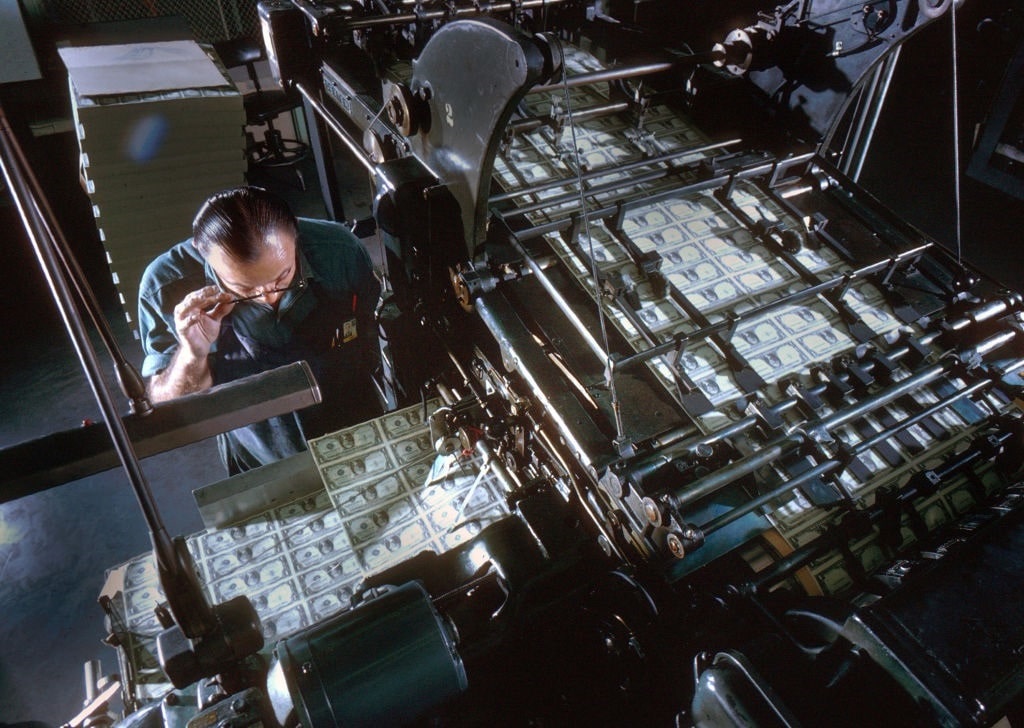

Federal Reserve Money Supply Data

For the fourth consecutive month, the Federal Reserve’s M2 money supply – a measurement of the nation’s money supply – increased in June, ballooning by $73 billion to $21.03 trillion. This is the first time that the country’s money stock has touched this level since February 2023. In fact, it is inching closer to where it was when Fed officials launched the institution’s quantitative tightening cycle (a blend of hikes to interest rates and reducing the balance sheet) in March 2022.

What’s more, this is a complete reversal of what occurred throughout last year. In December 2022, money-supply growth had tumbled by nearly 1% for the first time since the Fed started publishing this data in January 1960, taking over from the Census Bureau. Historically, the money stock has contracted three other times over the past century.

What’s more, this is a complete reversal of what occurred throughout last year. In December 2022, money-supply growth had tumbled by nearly 1% for the first time since the Fed started publishing this data in January 1960, taking over from the Census Bureau. Historically, the money stock has contracted three other times over the past century.

Despite the Eccles Building allowing its printing press to rest for a little bit, the amount of money in circulation is approximately 36% higher than before the coronavirus pandemic. In February 2020, the M2 was $15.432 trillion, more than double its level prior to the 2008-2009 global financial crisis.

Money supply statistics are valuable insights. Say’s Law – an economic concept from 19th-century economist Jean-Baptise Say – explains that the total supply of goods and services will equal the total demand for goods and services. This is most noticeable in the financial markets when supply manufactures its own demand, to paraphrase John Maynard Keynes. Investors will tap into this liquidity and drive up equity prices, distorting the fundamentals.

Or, based on the economic literature written by Ludwig von Mises and others in the Austrian school, inflation (money supply expansion) cooks up recessions and depressions, manufactures malinvestment, and erodes freedoms.

Is Policy Restrictive?

For all the claims of how restrictive monetary policy is, a chorus of Fed economists has questioned the narrative. Kansas City Fed economists penned a May 2024 paper titled “Current Monetary Policy May Be Less Restrictive Than It Seems.” Citing the previous inflation cycle in the 1980s, they asserted that “current monetary policy may need to remain restrictive for longer to return inflation to target.”

Other high-profile names, such as Dallas Fed chief Lorie Logan, have entertained this possibility. “There are also important upside risks to inflation that are on my mind, and I think there’s also uncertainties about how restrictive policy is and whether it’s sufficiently restrictive to keep us on this path,” Logan said at the Louisiana Bankers Association’s annual conference in May.

The Fed’s inflation target is 2%, and though Powell does not believe the personal consumption expenditure (PCE) price index or the consumer price index (CPI) will reach that percentage until 2026, he conceded that the central bank could pull the trigger on a rate cut before inflation returns to this level. As Liberty Nation News has reported, the reason emanates from the wisdom of economist Milton Friedman, who contended that monetary policy operates with a “long and variable lag.” This means that it takes as long as two years before the effects of Fed policy decisions are felt in the broader economy, including inflation.

Various data points highlight that US financial conditions are certainly loose. For example, the Chicago Fed’s National Financial Conditions Index has been parked in subzero territory for four straight years, meaning that the nation has been entrenched in loose financial conditions. How is this possible with a benchmark interest rate of 5.25% to 5.5%? It must have been and continues to be the Federal Reserve’s money-supply expansion.

Is it any wonder why one prominent economist gives the organization an “F” grade? “The US Federal Reserve is not paying any attention to the money supply. Chairman Powell has trashed the money supply idea,” economist Steve Hanke recently told host Julia La Roche. “That’s why the Fed has been unable to predict the course of inflation.”

Everyone Can Taste the Cuts

Everyone, from the Federal Reserve to the financial markets, can taste the rate cuts. The central bank’s Summary of Economic Projections indicates a quarter-point reduction. The futures market is pricing in at least two rate cuts before the year’s end. The big banks are forecasting several rate cuts in 2025. Of course, it might be a case of déjà vu all over again, as the public had projected 2024 to be the year of extensive slicing and dicing by the central bankers. Data from the 1970s and 1980s signal that the United States could be reliving history, meaning that the Fed would have to delay or hike should there be a revival of inflationary pressures next year and beyond. As the old saying goes, follow the money. In this case, it is easy to find: the Eccles Building’s basement.