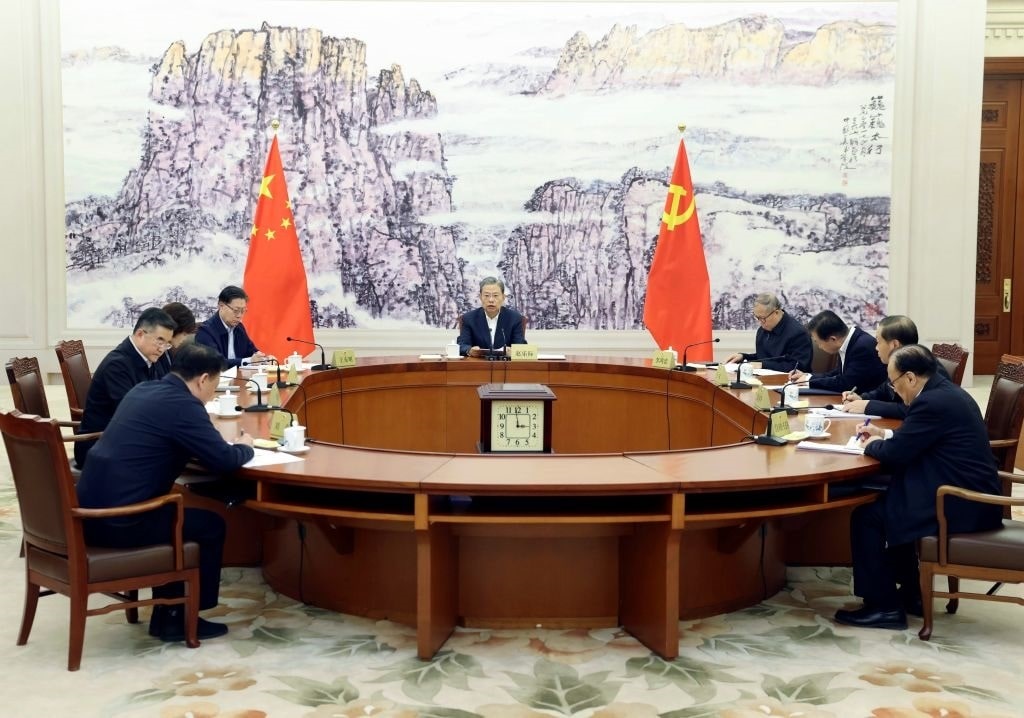

China just completed its four-day Third Plenum, a major meeting of Chinese Communist Party (CCP) officials held about every five years to determine the nation’s long-term economic and social policies. This year’s event failed to generate excitement in the world’s second-largest economy as President Xi Jinping and his henchmen vowed to move ahead with deep national reforms. With conditions deteriorating quickly, Beijing might need more than tepid change to plug the sinking ship.

China’s Third Plenum Takeaways

The CCP central committee outlined its Third Plenum Communique on July 18, confirming that Beijing “will adopt a resolution of further deepening reform comprehensively.” So, what does this mean? The list is pretty broad and vague, without any extensive explanation of how China will adjust its socialist economy. For example, the government aims “to deepen the reform of the foreign trade system” and to “carry out social security risk prevention and control network, effectively maintain social stability.”

Officials were specific on one thing: the green economy. Beijing says it “will deepen supply-side structural reform, establish and develop new growth drivers” by concentrating on all things green, be it innovation or consumption. This should certainly perturb the US administration as Washington is slapping tariffs on China for employing the same public policy pursuits as the White House.

Officials were specific on one thing: the green economy. Beijing says it “will deepen supply-side structural reform, establish and develop new growth drivers” by concentrating on all things green, be it innovation or consumption. This should certainly perturb the US administration as Washington is slapping tariffs on China for employing the same public policy pursuits as the White House.

China hopes to reach these objectives by 2029 and 2035. Can it be done? It all depends, says Lynn Song, the chief economist of Greater China at ING. “The key will be the follow-up on this meeting,” he wrote in a research note. “In the end, whether or not China can successfully transition its economy to the next stage of development will depend on how effective policymakers are in achieving these long-term goals.”

Indeed, economists and market watchers were disappointed. Yes, the meeting refrained from discussing prescriptions for short-term challenges. But they were, at minimum, anticipating announcements of fiscal reforms. So, for now, the Chinese population will have to accept the Five-Year Plan, a hallmark of socialism, and hope that the problems inflicting the nation will be resolved.

Wait a minute … problems? China is still going through issues? Yes, and conditions are deteriorating.

Big Trouble in Little China

The Chinese economy expanded 4.7% in the second quarter, down from 5.3% in the first quarter and short of the consensus estimate of 5.1%. This was the worst annualized reading since the first quarter of 2023, driven by a slumping yuan, the perpetual residential property downturn, weak domestic consumption, and trade issues with the US and Europe. US financial markets are largely ignoring what is transpiring in China, and even crude oil prices have shrugged off the news despite Beijing being the world’s top petroleum importer.

While the quarterly data might be outdated, there is reason to believe these issues will persist based on the June-July figures. Last month, industrial production rose at the slowest pace in three months and fell short of the market forecast of 5%. Retail sales climbed 2%, the smallest rate in 18 months, and clocked in below the projection of 3.3%. The nostrum of good news is industrial capacity utilization, which ballooned to 74.9% in the three months ending in June.

The meat and potatoes of China’s woes are the real estate market and the banking system.

China’s new home prices in 70 cities plunged by 4.5% year-over-year in June, marking the 12th straight monthly decline and the fastest pace since June 2015, according to the National Bureau of Statistics. On a month-over-month basis, new home prices tumbled 0.7%, the sharpest slide since October 2014. Property investment decreased by more than 10% compared to the same time a year ago, while new property sales cratered by 28%.

Chinese officials have attempted to stop the hemorrhaging with $42 billion in measures, announced in May. Some of these efforts consist of providing cheap loans for state-owned enterprises for purchasing unsold homes from distressed developers and trimming the minimum down payment ratio for first- and second-time homebuyers. Larry Hu, chief China economist at Macquarie, told CNBC that the government is also acquiring housing stocks to extend additional liquidity to property developers. “Finally, the government stepped in as the buyer of the last resort,” he said.

Experts do not expect these strategies will generate instant results. Will it work in the future? The odds are slim, considering how public policymakers have thrown everything but the kitchen sink since the last crisis a decade ago. Or perhaps even if the CCP successfully digs itself out of this deep hole, history will repeat itself.

Forty banks disappeared from China’s financial sector. They were absorbed into the bigger entities, and regulators have issued warnings for approximately 3,800, totaling hundreds of billions of dollars and representing 13% of the country’s banking system. These companies are struggling because they lent money to local governments and developers and became overexposed to the Chinese real estate market.

India Battles China for GDP Supremacy

The International Monetary Fund (IMF) released its World Economic Outlook report on July 15, forecasting that China’s economy will grow 5% in 2024 and 4.5% in 2025. While this is double that of the US and Euro Area, it is below India’s. The global organization projects that India’s growth prospects will be 7% this year and 6.5% next year. Does this mean India is the new China? It has a long way to go since Beijing’s GDP is around $18 trillion compared to New Delhi’s roughly $4 trillion. However, should the South Asian state maintain its growth trends and China struggle to stay afloat, it could be interesting times ahead.

In this Lost Decade 2.0, it might be time to ditch the Baiju and pass the Masala chai.